We’ve surveyed many financial advisors about this, and we’ve talked to their clients, too.

This fear is real, and it feels urgent, especially when someone we know or love crosses paths with home burglary, natural disaster, or the Big D’s — disease, disability, divorce, or death.

Here’s the brutal truth about how random life can be.

Crazy things happen all the time that put financial planning clients in crisis.

The trouble is that their crisis often becomes YOUR crisis.

- A client may die unexpectedly, leaving a mess for the family to try to untangle and clean up. That creates extra — likely uncompensated — work for you, doing your best to help them pick up the pieces and cope with their new reality.

- It could be that one partner was the active client and the other was just a passenger. When the dust settles, the business may move to a new advisor because the surviving spouse never took enough interest in the finances to develop a trusted relationship with you in the first place.

- That could mean lost revenue and more time to apply toward marketing your business when what you would rather do is serve clients and call it good.

Sobering stuff, don’t you agree?

What if — by starting new conversations with clients before life hits a bump in the road — you could serve them more deeply, fill a blind spot in their practical financial planning, and set you all up to save time, aggravation, and more heartache when life serves up a challenging turn?

And what if by serving clients in this deeper way, you welcomed quality, reliable referrals from existing clients who were only too happy to sing your praises to their friends and family?

These are all welcome outcomes that serve everyone in ways that are priceless in value and so easy to achieve with some deliberate focus.

Let me paint a powerful picture about what AFTER could look like for you with Life Goes on Roadmap™ in your toolbox …

Before

No tools, systems, or roadmap to support clients to get their acts together before life hits the fan.

After

One simple system to get the job done that doesn’t take your valuable time and makes the most of theirs!

The PROBLEM Life Goes on Roadmap™ Solves for Advisors

Just about everyone agrees that it is important to guide clients to get on the same page with regard to organizing their household operations, investment accounts, important contacts, passwords, insurance information, beneficiary designations, and final wishes.

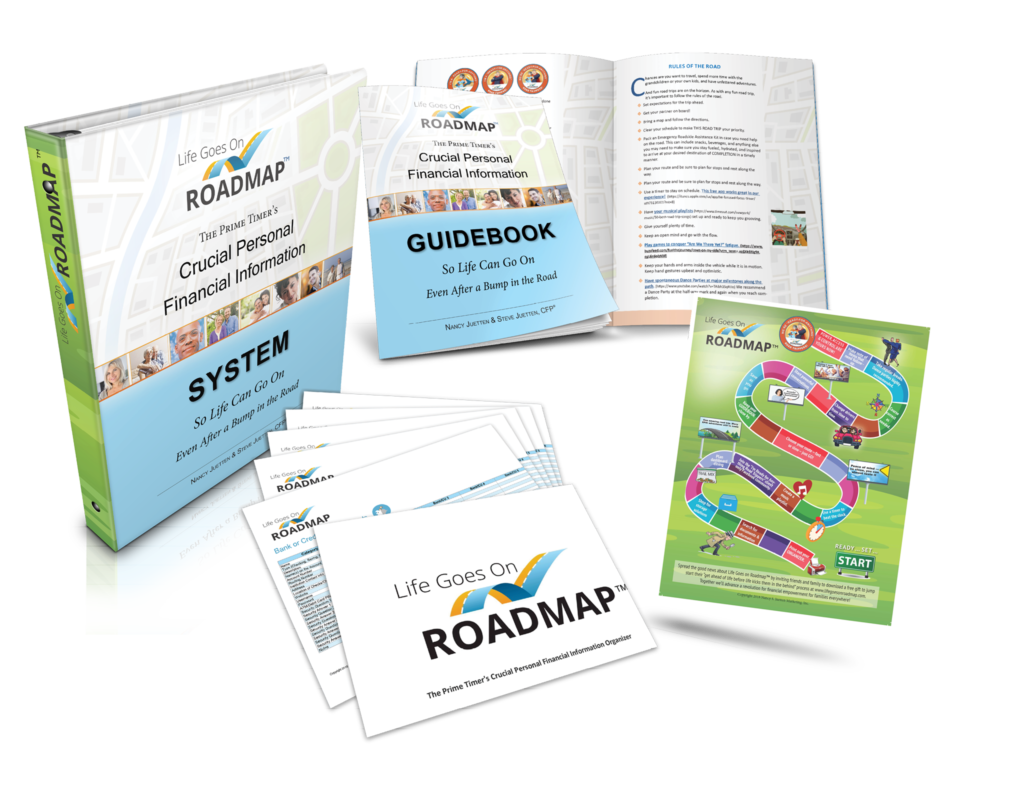

Life Goes on Roadmap™ is a powerful system for personal financial information and document organization that financial advisors can license as their own. It offers a way to demonstrate their fiduciary duty to clients before a home burglary, natural disaster, or one of the 4 D’s — disability, disease, divorce, or death — hit close to home.

It offers a way to demonstrate their fiduciary duty to clients before a home burglary, natural disaster, or one of the 4 D’s — disability, disease, divorce, or death — hit close to home.

This collection of proven, practical and empowering tools prepares clients and their families for “What If” moments before they become hardships while igniting powerful conversations that need to happen before life serves up a bump in the road.

Clients get to participate in virtual Get It Done Days hosted by the co-founders live or by replay to make the most of their busy lives. Everyone gets on the same page before a crisis hits, and that can save a lot of drama, trauma, and chaos for all involved – including the advisor — when the rubber meets the road in life.

Advisors across the nation and in Canada use this system to add value to their existing services, deepen client relationships, set themselves apart in the marketplace, invite referrals, and make more money.

Simple to Implement

All advisors need to do is bring a sample of their customized Life Goes on Roadmap 3-ring binder to offer as “show and tell” at every get acquainted session or client service appointment. That makes it easy to start the conversation with clients around getting organized before life takes a challenging turn.

Advisors offer a simple letter that we provide for them that makes it easy for clients to access their digital materials, and the co-founders do the rest.

Delight Clients and Invite Quality Referrals

Clients see great value in the system and often refer family and friends back to the advisor who presented it in the first place. That makes building a practice easier, while being of great service to everyone involved.

Before Life Goes on Roadmap, advisors were doing their best to patch together a way to guide their clients to get their acts together.

After deciding to share Life Goes on Roadmap with their clients, they now get the benefit of a proven, playful system that gets the job done that doesn’t take their valuable time to implement.

LPL, Garrett Investment Advisors, and other compliance departments have reviewed and approved the system for use by their advisors.

That makes it faster and easier for others to join and benefit!

PRICING

NAPFA and Garrett Planning Network members qualify for a 10% discount on the licensing fee. Visit www.bit.ly/deeperservice to view an on demand webinar, learn more, and schedule a licensing discovery session with Nancy Juetten to create a triple win for your clients, their families, and your own growing financial planning or investment advisory practice. You can also send email to Nancy@lifegoesonroadmap.com or call 425 641 5214.