For Immediate Release

January 30, 2019

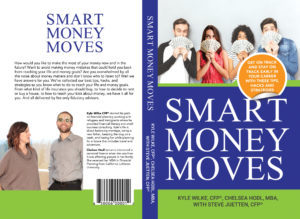

Three financial planners from Juetten Personal Financial Planning, LLC have released a new book for professionals early in their careers about getting on track and staying on track with their money, just in time for goal setting in the new year.

Three financial planners from Juetten Personal Financial Planning, LLC have released a new book for professionals early in their careers about getting on track and staying on track with their money, just in time for goal setting in the new year.

Smart Money Moves: Get On Track and Stay on Track Early in Your Career with These Tips, Hacks, and Strategies is now available for purchase at www.amazon.com.

“Money matters are top of mind at the start of a new year. Smart Money Moves is a perfect gift or resource for 20-and-30-something professionals to help them get off to a good start managing their money. It’s an easy read and a useful resource packed with hacks, tips and strategies to make the most of their money and their lives,” says Steve Juetten, CFP® , Founder and Principal of Juetten Personal Financial Planning, LLC.

When money questions come up around buying a car, starting a new job, or deciding to start a family or buy a house, while figuring out how to pay off student debt, Smart Money Moves is the book to turn to, Juetten suggests.

Co-authors Kyle Wilke, CFP® and Chelsea Hodl, MBA, are early career professionals who confer with and advise 20 and 30-something career professionals about money matters. That is refreshing for clients who prefer to talk to peer experts as opposed to advisors who are decades older.

20 and 30-something career professionals about money matters. That is refreshing for clients who prefer to talk to peer experts as opposed to advisors who are decades older.

Roseanney Liu, a nonfiction author and speaker from Los Angeles read the book and had this to say about it:

“Filled with eye-opening eureka moments was my experience reading Smart Money Moves. The financial advice shared with millennials and early career professionals is timely and on par with great wisdom that will help readers be on the right track to financial security and success. As someone with young children, I was pleasantly surprised by tips on the differences between pre-paid tuition plans and education savings plans and that bank accounts may be set to P.O.D. (read the book to find what it means) condition in order for beneficiaries to not pay estate taxes. It was interesting to realize the differences between credit freeze and a credit lock and they both can safeguard one’s financial identity. The advice about how to smartly research and choose debt consolidation companies is excellent for those seeking this avenue to pay down their debts. The explanation on how Bitcoin works and its risks are refreshing for me, as someone not well-versed on this digital wallet account works, and the advice is sound on why fee-only financial advisors and personal (not online) estate planning attorneys are best. Overall, Smart Money Moves is a wonderful, easy to understand financial advice book for millennials, and I look forward to implementing some things I have learned and sharing it with my children as it’s never too early to sow the seeds for one’s financial security.”

About Juetten Personal Financial Planning, LLC

Juetten Personal Financial Planning, LLC is comprised of fee-only financial advisors who act as fiduciaries for their clients. This means advisors do not sell any products or receive commissions, and advisors always act in each client’s best interests. Clients engage for financial planning and investment management.

The Financial Foundations Program is a special division of the company that focuses on working with those early in their careers. The Financial Foundations Program was started by Juetten Personal Financial Planning LLC. as a way for early career professionals to affordably obtain high quality fee-only financial planning. Early career professionals face unique challenges such as high housing costs, student loans and a dynamic workforce. Advisors focus on client goals and empowering clients to make smart money decisions. Purchase Smart Money Moves as a print or digital item at Amazon.com.